Research

Research your family history, get homework help, read current newspapers, and more with Pratt Library research resources. Browse subject guides, databases, and digital collections or chat with a librarian to get started. A Pratt Library Card is required to access many of our databases.

Featured Databases

Nature

Nature is a British weekly scientific journal featuring peer-reviewed research from a variety of academic disciplines, mainly in science and technology.

Credo Reference

Start your research with millions of online full-text and subject-specific reference books, articles, images, audio files, and videos covering over 11,000 topics.

Enciclopedia Estudiantil Hallazgos

World Book’s excellent editorial content, rich media, and interactive features in Spanish.

Maryland Newspapers

Search current and historical Maryland newspapers, including The Baltimore Banner and over 100 years of the Baltimore Sun and Baltimore Afro-American.

Featured Research Guides

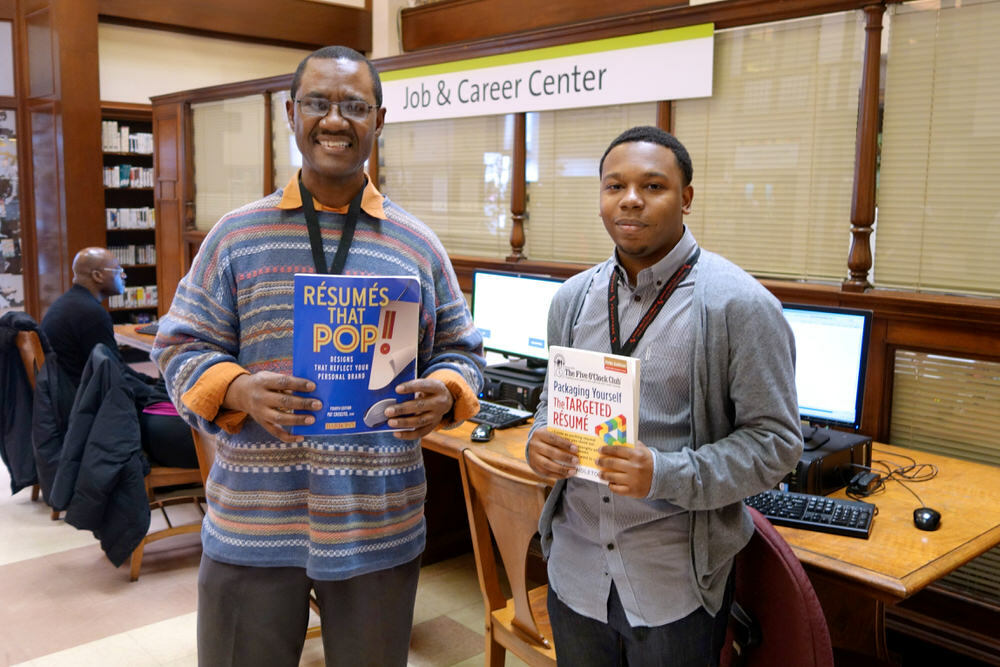

Job Seeker's Toolkit

Looking for a job in Baltimore? This toolkit is designed to support job-seekers and those who assist job-seekers.

COVID-19 Vaccine Information

Use this guide to find trusted and reliable news sources related to the Coronavirus COVID-19 vaccine.

Genealogy & Family History Research

Research your family history and genealogy with extensive resources, both in person and online.

Evaluating Old Books

Ever wonder how much your old books are worth? The Humanities Collection has resources to help you find out.

Got a Question? Ask a Librarian!

During Pratt Library hours you can live chat with a librarian. Prefer to talk on the phone? Call (410) 396-5430 for answers to reference questions.

Chat with a LibrarianDigital Maryland Collections

Providing online access to digital versions of rare and unique materials, including historical maps, photographs, reports, books, manuscripts, artwork, and other media. To view more digital collections from libraries, museums, archives, and other institutions throughout Maryland, visit Digital Maryland.

View the CollectionCentral Library Departments

Find librarian expertise, books, media, microfilm, and more in Central Library Departments. Explore Departments related to subjects from Maryland history and fine arts to job seeking and teen resources.

View the Departments